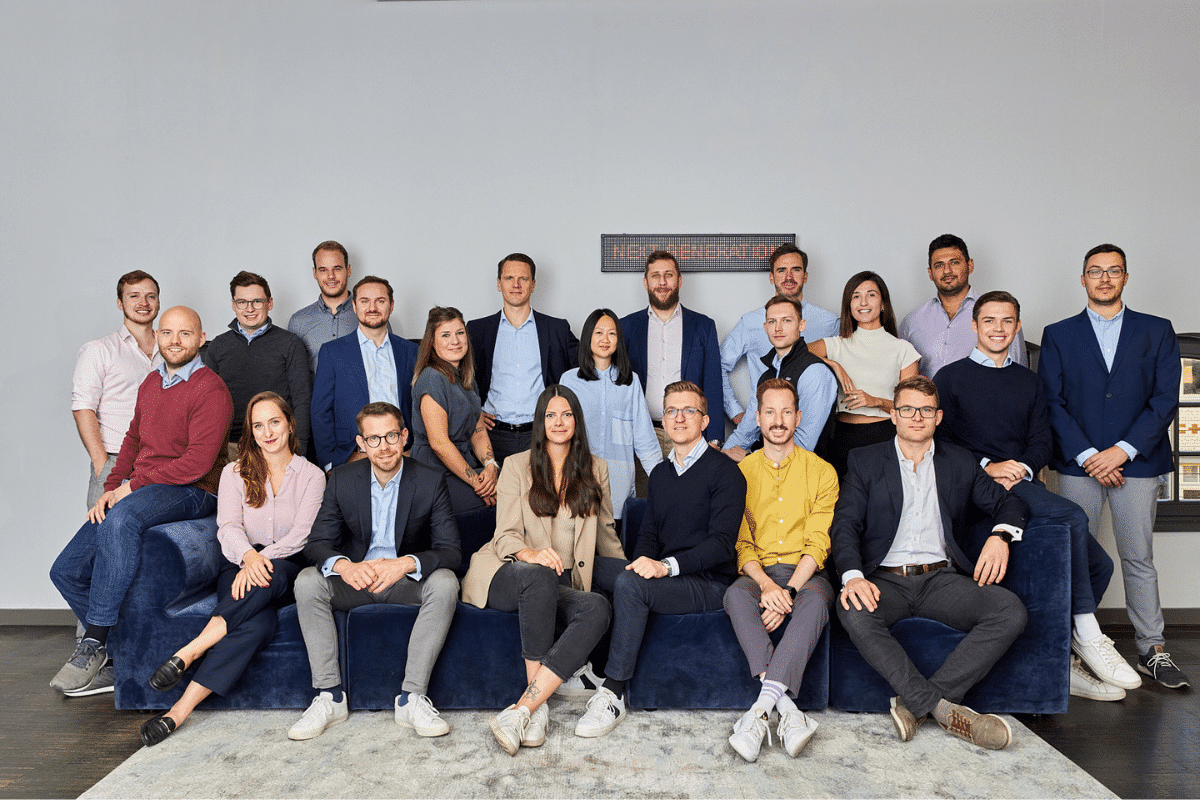

- FLEX Capital, the next generation private equity fund, takes over the majority of ComX, a market-leading B2B sales enablement platform for companies with services and products that require explanation. ComX is the only company in the world that offers a solution for the entire sales value chain for companies with complex B2B products and services.

- By optimising and automating sales cycles, the company helps its customers generate millions in new business.

- Since its foundation in 2018, ComX has had an annual growth rate of over 125%.

- ComX has more than 400 medium-sized customers, including blue chip companies such as Avira and Randstad.

- FLEX Capital will support ComX in particular with product innovation and with the professionalisation of its internal company structures in order to drive the expansion forward.

FLEX Capital takes over the majority stake in ComX, a market-leading B2B sales enablement platform, in order to develop the company together with the founders from a hidden champion to one of the world’s leading SaaS providers for automated sales.

ComX is the only company in the world that offers a solution for the entire sales value chain for companies with complex B2B products or services.

The bootstrapped company based in Berlin and Cape Town was founded in 2018 by Philipp Ströhemann, Christoph Erler and Peter Hidden. Since then, the company has shown annual growth rates of over 125%.

Solving the medium-sized sales problem

Many medium-sized companies often work with a classic sales approach that does not manage to generate new customers continuously and in a predictable manner. At the same time, sales are usually very costly and time-consuming because there is a lack of sales experts and processes are not digitised: sales processes are usually neither automated nor measurable, despite the implementation of complex CRM systems.

According to FLEX Capital evaluations, there are more than 800,000 B2B medium-sized companies in Europe that will have to rely more on a digital sales channel in the future in order to remain competitive. According to McKinsey, B2B sales managers who use digital solutions are seeing five times the growth in new business compared to their competitors who rely on completely analog sales structures. Despite this considerable potential, only every fourth company has automated at least one sales process.

ComX already helps over 400 medium-sized and blue-chip companies, such as the cyber security provider Avira and the personnel service provider Randstad, to optimise their sales.

The company makes it possible to win new customers strategically and predictably by shortening sales cycles to a few days through automation and digitisation of processes, making every step of the deal cycle measurable and thus building millions in new business. ComX customers particularly benefit from the outsourcing effect on time-consuming tasks in the sales process that add little value. With its platform, ComX is a pioneer in the digital transformation of B2B sales processes that classic CRM systems do not cover.

“Signals for the current shift in B2B sales towards a hybrid sales model have been evident in the market for years,” says Christoph Erler, co-founder and COO of ComX. “Drivers include: the growing need for constantly updated, GDPR-compliant data, the use of machine learning and natural language processing, and the focus on personalising customer communications.”

“ComX is in a very exciting, rapidly growing market. The area of automated sales is characterised by strong M&A activities and is also an issue for many well-known big tech companies. Adobe, Oracle, SAP, Salesforce and IBM have entered the enterprise marketing automation market through acquisitions,” says Peter Waleczek, Managing Partner of FLEX Capital. “What makes ComX special in this field is that they are the only company in the world that covers the entire sales process with their solution. They have product features that not even a Hubspot or LinkedIn Sales Navigator can match.”

Bootstrapped companies need smart money

In order to turn the company into a global player, the ComX’s founders need particular expertise in the areas of software and the Internet. “We made a conscious decision in favour of the private equity investor FLEX Capital and against venture capital financing. Because in order to realise our vision, we need an experienced partner who knows the market in which we operate very well and who knows what steps are necessary to make our company fit for the global stage,” says Philipp Ströhemann, co-founder and CEO of ComX. “FLEX Capital suits us; we trust in their experience and we are convinced that with the support of this private equity fund, we can achieve the next big step in growth.”

In order to accelerate international growth, the next generation private equity fund will in particular promote product innovation and support the professionalisation of ComX’s corporate structure, for example by strengthening the second tier of management and professionalizing corporate structures.

“We are pleased that we have convinced ComX of our entrepreneurial background. In a short time, the founders have developed an important product to strengthen German-speaking medium-sized businesses. I look forward to taking the next growth steps together with the founders and preparing the company for internationalisation,” says Christoph Jost, Managing Partner of FLEX Capital.

“With Pipedrive, we have already succeeded in elevating a software company from Europe to the global stage. We are convinced that ComX will be the next software company that will play a global role – only this time it will be made in Germany,” says Waleczek.