ESG at FLEX Capital & portfolio

Our responsible investment guidelines

1. selection phase

Exclusion criteria

All companies that violate our specific exclusion criteria are rejected as investments. These exclusion criteria include all industries, business models and activities in which we generally do not invest due to our commitment to sustainable corporate governance and ethical and moral reasons. Click here for the complete list. Another exclusion criterion is serious corporate misconduct in environmental, social or governance sectors.

ESG due diligence

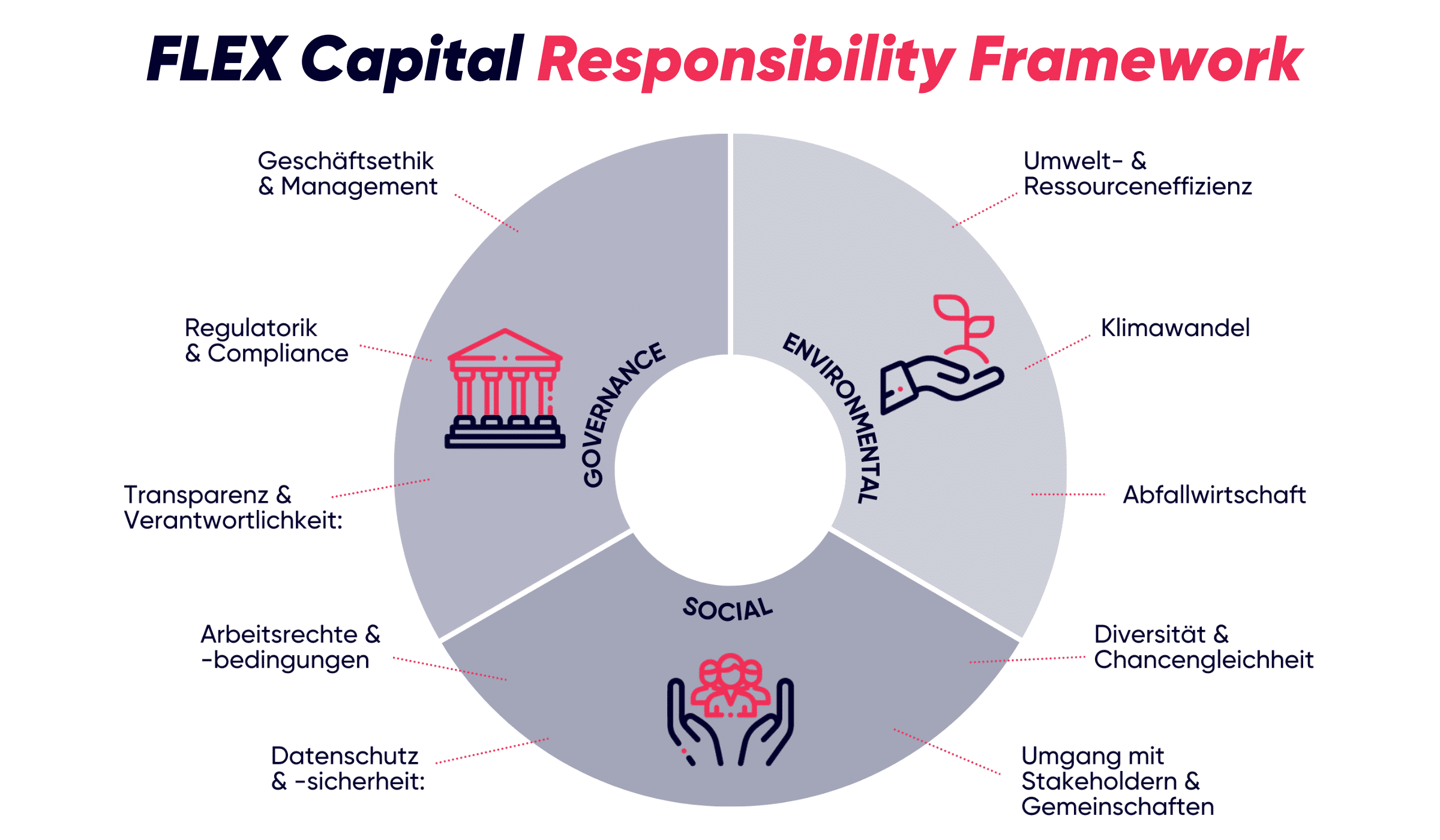

As part of the investment process, we carry out an ESG due diligence in which we examine and evaluate a potential portfolio company regarding relevant ESG factors, which we record in our Responsibility Framework.

Environmental

- Environmental and Resource Efficiency: Responsible and efficient use of resources, including water and energy, as well as the utilization of sustainable energy sources.

- Climate Change: Strong environmental awareness and commitment to promoting carbon neutrality, especially in terms of travel and fleet management.

- Waste Management: Reducing the amount of waste generated and environmental pollution caused by waste disposal through recycling and reuse.

Social

- Diversity & Equal Opportunities: Actively promoting diversity and ensuring equal opportunities regardless of gender, ethnicity, disability, or religion.

- Stakeholder & Community Engagement: Respect for the local societal contexts in which we and our portfolio companies operate, as well as respectful engagement with all our stakeholders.

- Data Privacy & Security: Adequate data protection measures in handling all private data and compliance with local regulations.

- Labor Rights & Conditions: Adherence to labor rights and ensuring working conditions that go beyond basic health and safety standards.

Governance

- Business ethics & management: Compliance with standards regarding good corporate governance and ethical behavior, especially about corruption, harassment, and other misconduct.

- Regulation & Compliance: Adherence to all laws and regulations according to local applicable requirements.

- Transparency & Accountability: Transparency regarding our ESG commitments and the progress of their implementation, including regular reporting on all ESG-related issues.

This analysis is primarily based on our specified ESG due diligence questionnaire, which must be answered by the company’s management, as well as other ESG-related data (e.g. gender diversity of the workforce, governance guidelines, etc.). The central element of our sustainability assessment remains good corporate governance as a starting point in order to identify opportunities and risks at an early stage and to avoid them. Then the individual material factors from the environment and social issues are determined and evaluated. The results of the analysis are recorded in our ESG rating. The rating comprises a total of 17 criteria, divided into the three areas of environment, social affairs, and governance. For each criterion, the respective company is rated in one of the three following categories:

Compliance with minimum requirements, good practice, excellent practice. The individual requirements for the respective evaluation category are individually defined for each criterion. The result of the ESG analysis is then combined with the result of the commercial, financial, legal, and technical analysis. For a positive investment decision, every company must meet the minimum requirements of the ESG due diligence rating. In addition, the ESG rating has an impact on the company’s value.

2. Value creation phase

ESG Scorecard

During the value creation phase, we address our ESG-specific expectations to portfolio companies and support the portfolio company’s management in minimizing ESG risks and identifying ESG opportunities. We use the ESG scorecard that we provide to record the portfolio companies’ progress in terms of ESG management. The scorecard includes the development of the following areas:

3. Exit phase

And beyond

When preparing for the exit, appropriate measures are taken so that the portfolio company is positioned to continuously improve its ESG performance. The goal is to identify and implement improvements in the areas of ESG during the exit.

Our responsible investment guidelines

Responsibilities

ESG responsibilities are divided as follows: Managing partner: Approval and supervision of all ESG activities. ESG commissioner: Development and implementation of the ESG strategy. Investment team:

- Find investments that are in line with our responsible investment approach

- To apply ESG due diligence to new investments

- To ensure management pursues ESG matters further

Declaration on remuneration policy

As part of our remuneration policy, sustainability risks are considered when determining the variable remuneration component as follows: Employees who take unreasonably high sustainability risks when making investment decisions or who contribute to such risks being taken should not receive a variable remuneration component. This regulation is intended to encourage employees to take sustainability risks into account when making investment decisions and not to take such risks recklessly.

Updates

All information is continuously checked and, if necessary, updated.

Exclusion list

As a private equity fund, we have decided not to invest in certain sectors, business models or activities due to our commitment to sustainable corporate governance and our ethical and moral convictions. Our exclusion list includes all companies that

- manufacture illegal products or engage in illegal activities in accordance with applicable local laws.

- have a production or other activity that involves harmful or exploitative forms of forced or child labor.

- have shown a systematic denial of internationally proclaimed human rights principles.

- deal with products and activities that are prohibited by global conventions and agreements.

- are involved in the delivery or purchase of sanctioned products and goods to or from countries or regions that are subject to United Nations sanctions.

- Participate in systematic non-compliance with environmental regulations.

- Manufacture, distribute or sell weapons or ammunition, or supply products or services especially for the purposes of war.

- Manufacture, sell or distribute pornography, gambling products or services, tobacco, or alcohol.

This list is not exhaustive, and a separate assessment must be made for activities not included in the list but involving similar risks.

Do you have questions about our values or how we implement and live ESG at FLEX Capital on a daily basis?

Investment Manager & Investor Relations