Erhalten Sie innerhalb von zwei Werktagen eine indikative Bewertung Ihres Unternehmens.

Wir berechnen auf dieser Basis gerne einen indikativen Wert Ihres Software- oder Tech-Unternehmens. Für eine genauere Bewertung müssen wir im zweiten Schritt weitere sensible Daten erfragen, für die wir Ihnen vorab eine Vertraulichkeitsvereinbarung zukommen lassen.

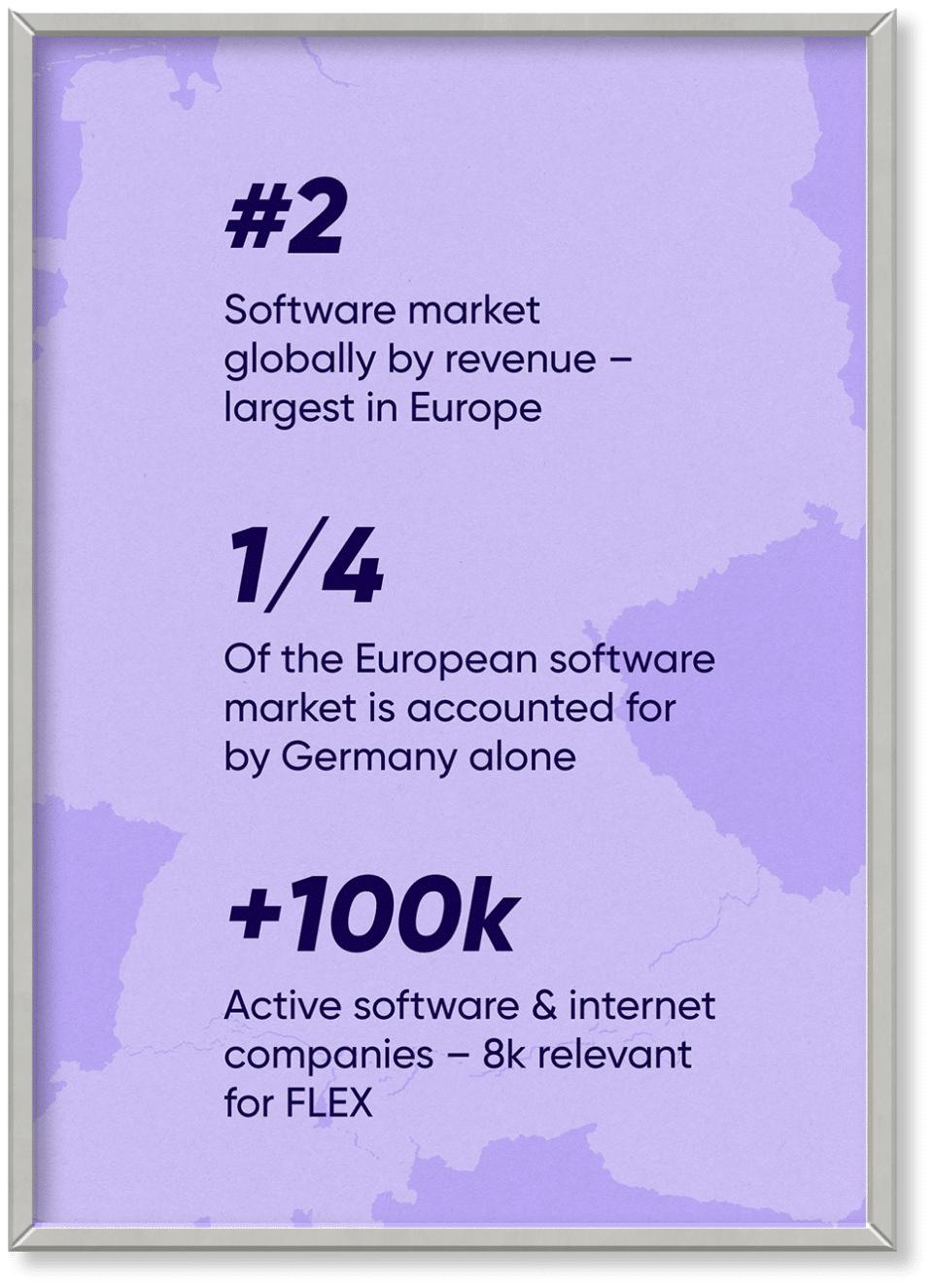

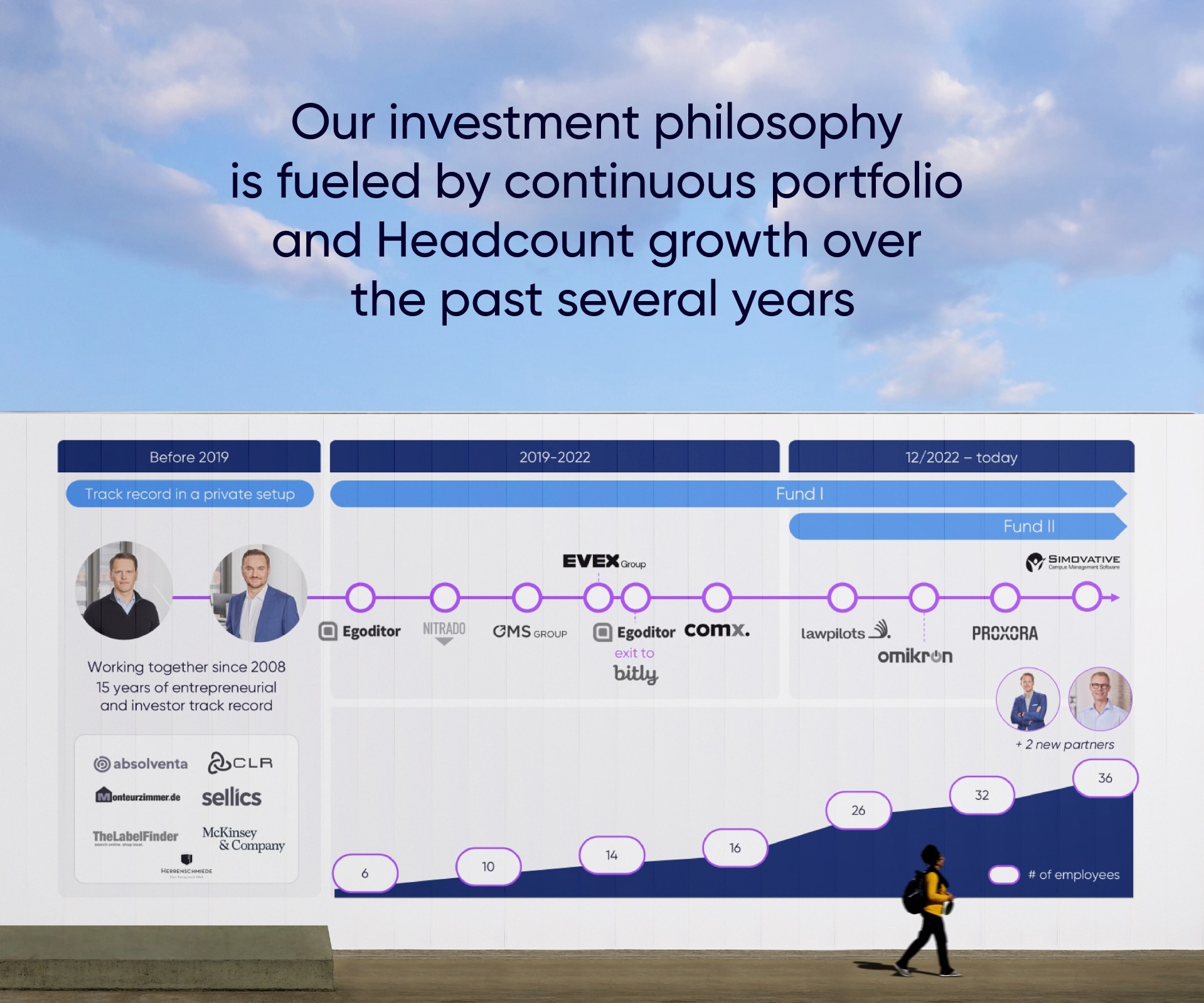

*FLEX Capital ist ein Private-Equity-Buyout-Investor mit Spezialisierung auf den Softwaresektor. Wir verfügen über maßgebliche Expertise bei der Unternehmensbewertung in diesem Segment.