Whether companies should adjust EBITDA during the sales process or not is a question that most entrepreneurs grapple with when considering a potential sale. As investors, we encounter EBITDA adjustments in nearly every other company, prompting us to actively engage in their evaluation and the reasons behind them.

EBITDA adjustments (or normalizations) involve correcting EBITDA to exclude expenses that are one-time occurrences, non-recurring, and therefore not attributable to the operational activities of the business. The adjustment thus positively impacts the company’s valuation. From an investor perspective, these adjustments are acceptable as long as they relate to one-time events. However, since certain adjustments can be challenging to classify as non-recurring, we usually analyze them particularly thoroughly.

On average, 12% of the EBITDA is adjusted

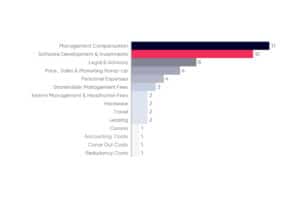

The prevalence of EBITDA adjustments becomes evident when considering the following figures: Out of nearly 70 companies I’ve examined on this matter, 36, which is over 50%, have EBITDA adjustments. Excluding outliers, these adjustments increase the EBITDA by an average of about 12%, consequently enhancing the company’s value. On average, the EBITDA of these companies increases by approximately €330,000. Moreover, among the 36 companies, we identified 65 different adjustments, which often exhibit similarities. It’s apparent that non-recurring events are primarily normalized, such as management salaries and bonuses, consulting and legal fees, shareholder fees, as well as anticipated future price adjustments or expansions of sales and marketing teams. Similarly, costs for software development are capitalized, directly boosting EBITDA from an accounting standpoint, or development costs for software are considered as adjustments.

The most common adjustments: management compensation and software development costs.

- Management compensation – In 17 out of 36 transactions, management salaries, bonuses, and distributions were normalized. In most cases, this adjustment is uncontroversial and market-standard, as the directors could have paid themselves these compensations anyway. It’s important to note that the adjusted management compensation includes a “regular” director’s salary as well.

- Software Development – Companies can capitalize their self-developed software under commercial law, resulting in a positive impact on the accounting EBITDA. However, investors scrutinize this aspect carefully because the capitalization doesn’t apply in the tax balance sheet, and the costs capitalized for this purpose must have a coherent and sustainable relationship to the incurred expenses. The rationale is not that development costs aren’t recognized, but rather that these expenses and future opportunities are already factored into the overall company valuation.

Alternatively, we often observe that development costs are not capitalized but are normalized as a line item in the EBITDA.

- Legal & Advisory – Only in about 20% of transactions are expenses for lawyers, M&A advisors, or IT consultants listed as EBITDA adjustments – much like Management Compensation. In most cases, these are one-time expenses, such as the M&A advisor’s retainer during the transaction process or one-time legal consultation for the company. After the transaction, these costs should not recur.

On the other hand, if a company undergoes, for instance, a multi-year restructuring or needs to repeat the restructuring annually, these expenses are considered operational costs due to their regularity, which are inherent to the company’s purpose.

- Pricing, Sales & Marketing Ramp-Up – Similarly, price increases, sales, or marketing expenses are often normalized in many transactions. However, the approach varies significantly. For instance, if an entrepreneur anticipates a price increase at the time of the sale and includes it in the EBITDA, we would thoroughly analyze revenue and customer churn, seeking initial successes in implementing the price hike, when dealing with adjustments for Sales and Marketing, we adopt a similar approach, closely examining the underlying intentions, the personnel brought on board, and the projected revenue growth associated with these expenses in the future. Ultimately, adjustments in these areas need to be well-justified and, most importantly, realistic, as potential investors almost always raise questions in these domains.

- Personnel & Personal Expenses – Adjustments in personnel expenses, for example, involve modifications for employees who are not operationally aligned with the company, employees who are planned for reduction, or special payments like COVID-19 aid provided to employees.

A topic that is not often discussed is normalizations for personal expenses of executives. Adjustments can also be made in this regard if these expenses are not part of the operational business. In practice, this could include adjustments for leasing costs of exclusive company cars or salaries for family members, for example.

What adjustments are there outside the software sector?

While some adjustments are nearly typical for software companies (e.g., Software Development), there are also adjustments that we see less frequently. Among these is EBITDAR (R = Restructuring or Rent), which is more common in industrial companies. In EBITDAR, expenses are normalized that arise when business units are reorganized or rental payments for fixed assets are made. EBITDAR thus presents the operating result, adjusted for necessary expenses such as rent, interest, and depreciation related to fixed assets, and extraordinary non-periodic expenses and gains.

Similarly, WeWork took a similar approach during its planned IPO in 2018. The company attempted to establish a “Community Adjusted EBITDA” (EBITDA before building- and community-level operating expenses), which was met with significant investor skepticism. This was mainly due to the substantial discrepancy between the adjusted EBITDA figure presented at the time and the accounting EBITDA.

In summary, There is no fixed definition of what companies can normalize and what they cannot. Ultimately, it is up to the discretion of the sellers and the buyers to decide which adjustments are justified and which are not.