Amazon is making cutbacks – after 18,000 employees had to leave at the beginning of the year, a further 9,000 colleagues are now being laid off. Many other big brands like Spotify, Meta or Microsoft are like Amazon: Suddenly there are not just a few employees too many, but very many.

But how does this overstaffing come about? And what can entrepreneurs do to hire the correct number of people at the right time and with the right skills? In this article, we dare to take a number-based approach to workforce planning.

How companies recruit: three schematic hiring philosophies

When recruiting new staff, companies follow different approaches that show a varying degree of planning:

- “Lead hiring”: With lead hiring, entrepreneurs bridle the recruiting horse from behind. The aim here is to build up a strong team in the shortest possible time, which is supposed to put the planned business idea into practice – even if there is no concrete business case yet. Millions of investor funds are being collected to financially reflect this rapid increase in personnel. However, the crux of the matter is that if the vision cannot be implemented, mass redundancies often follow just as quickly. Lead hiring is particularly common in startups and fast-growing companies.

- “Lag hiring”: Lag hiring is a bit more planned. Instead of simply building up staff out of the blue, recruiting here is based on an acute need for personnel. Short-term peaks can be covered by overtime with the existing staff. However, if the workload is too high in the long term, overwork and the first cases of burnout spread. Then new employees are hired to fill the shortage of staff. The problem is: These cannot start tomorrow – but only in a few weeks or even months. And even then, they have to be trained first. Until then, the congestion remains. Employers therefore always carry out lag hiring on the backs of their employees. In the worst case, the problem multiplies. Because overworked employees become ill and are absent – the staff gap becomes even larger as a result. As a result, the remaining colleagues are overburdened and the workforce finds itself in an awkward position that is difficult to remedy – especially with regard to employee retention and satisfaction. Lag hiring is often observed in organically grown medium-sized companies.

- “Workforce planning”: Workforce planning goes a big step further. It plans the number of new employees needed based on the relationship with sales growth or other KPIs. The idea: You try to establish a correlation between the current employees and the business case of the company. A wide variety of KPIs can be used for this, depending on the industry and company.

Workforce planning via KPI: Basic KPIs for planning hiring

Entrepreneurs can use a wide variety of KPIs to plan the number of employees they need. The turnover per employee (sales : full-time equivalent FTE), the profit per employee (profit : FTE) or the human capital ROI (profit : employee costs) are often used.

The human capital ROI makes an interesting observation possible. Financial experts examine the question: How much income does the company generate for every euro invested in personnel? If the company achieves a profit of 5 to 6 million euros per employee, it can pay significantly higher salaries than if it were “only” 2 million euros.

As a rough estimate, sales per employee are always assumed to be EUR 100,000 if no other figures are available. Whether this number is realistic also depends heavily on the industry. For example, the figures in the agency environment differ significantly from those in the software industry.

Every job needs a business case

But how do you use a KPI to decide whether a new hire makes economic sense? What matters is that there is a business case for it. And that is when the benefit of the new employee is significantly higher than the costs. Every employee should generate around twice their annual gross income as sales or value added.

This can also be expressed in numbers. There are two ways of looking at this – shown in the example with a monthly gross of 5,000 euros:

In order to check whether there is a business case, entrepreneurs should take both perspectives: In which scenario is the benefit for the company greater? Is the profit possible from an additional employee realised? Or if there are no monthly costs?

Hiring a new employee only makes sense if this consideration is in favor of the value consideration. Unfortunately, this consideration is all the more difficult, the lower the correlation of a position with the selected ROI, for example in the case of an HR business partner or a controlling employee who has no direct influence on sales.

When does an employee reach their break-even point?

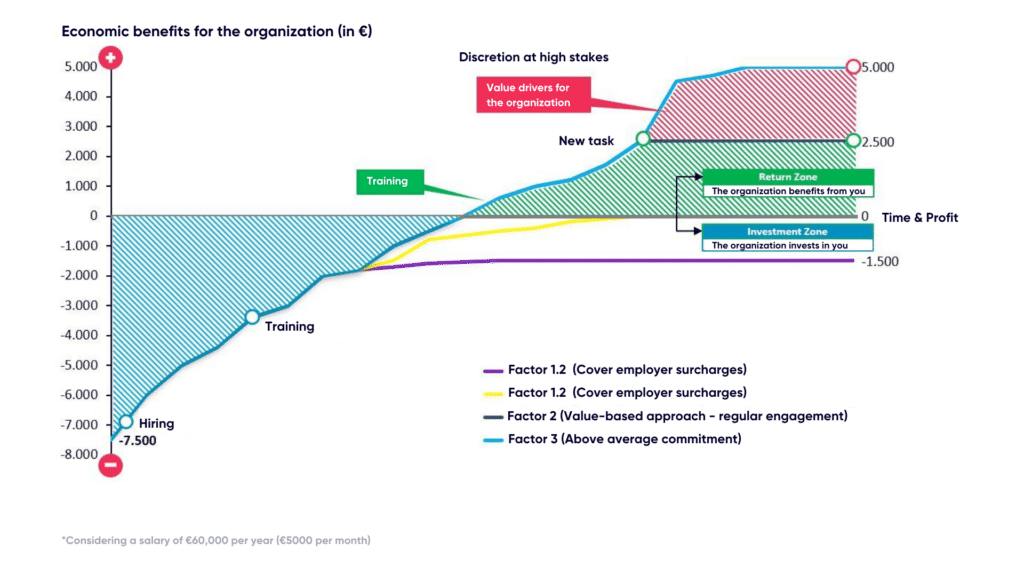

When is an employee profitable? How long will he stay in the investment zone? These questions can also be answered on the basis of the cost considerations already raised. First of all, it incurs costs. Continuing our example above, these are not just 5,000 euros, but about one and a half times as much. This factor of 1.5 includes the employer surcharges (approx. 20 percent) and other costs such as setting up the workplace, benefits or costs for employee management (approx. 30 percent). The costs per month are therefore 7,500 euros (5,000 euros x 1.5).

From the moment the new employee is hired, the employer is in the investment zone: the employee is initially still busy with onboarding and induction. It does not yet make any or only a small contribution to value creation and accordingly initially causes costs. As soon as he generates around one and a half times his monthly gross sales, he becomes cost-neutral. If he manages to further increase his efficiency, he will reach his break-even point and thus the profit zone.

The cost consideration shows how important this factor is: the longer the employee stays in the investment phase, the higher the personnel costs – and the less economical the hiring is. The scenario impressively shows how important good leadership and onboarding are. The faster a new employee integrates into his or her work task, the faster he or she will reach their break-even point. Depending on the complexity of the position, the quality of the induction and the qualifications of the employee or employees, this can take between two months and two years.

Personnel requirement determination: historical budget data as a basis

To clarify the principle, let’s assume that the workforce would grow linearly with sales. An example: With 10 employees, the company generates a turnover of 10 million euros. To increase sales to 12 million euros, the company would then need 12 employees as long as it could not realize any gains in efficiency.

However, the personnel requirements cannot usually be extrapolated so easily: many departments do not scale to this extent and therefore have to be taken into account with a lower correlation. For example, the HR or finance departments hardly grow as a function of sales, but rather with the complexity of the organization. Therefore, one would rather classify them with a low correlation of 0.2. Sales, on the other hand, is strongly oriented towards sales, which is why the correlation is closer to 0.8. Therefore, there is always a certain amount of estimation in every future forecast for non-sales areas of the company. Nevertheless, workforce planning also allows a relatively reliable forecast of future personnel requirements.

However, a high level of planning accuracy in the past is crucial. Because if entrepreneurs want to draw conclusions about the personnel requirements of the future from past values, inaccuracies can quickly lead to a larger buffer being required in planning.

Suppose the staff budget was undershot by 20 percent in the past. This would mean that the company should have at least a 20 percent buffer when planning for the number of employees to be hired. If, according to the forecast, the company needs ten new employees, it should only hire eight in this constellation. Otherwise, there is a risk that two employees would have to be made redundant if planning went wrong again. An alternative is deferred hiring. New employees are only hired when the goals set for each quarter have been achieved, thereby increasing planning security. This prevents the risk of overstaffing.

Workforce planning in smaller companies

In smaller companies, there is often the challenge that an additional employee represents a major financial hurdle. Suppose a company consists of only 15 employees. An additional sales representative would now be required. But it would only be worthwhile once the company has grown to 30 employees. Before that, it was just a cost factor.

There are several approaches to deal with this situation. Is the operating margin high enough to pay the new rep for a while, even if it’s not worth it yet? Is a part-time employee an option? Or can an existing employee take over the work in the meantime? Unfortunately, there is no clear strategy for this situation. It is the individual entrepreneurial risk of making the right decision and, if necessary, bearing the consequences of a wrong decision.

Workforce strategy: Hiring only with a business case

Depending on the industry, up to 80 percent of a company’s total costs can consist of personnel costs. This is particularly true for medium-sized software companies. A well thought-out workforce strategy is therefore important. Because hardly anything is more expensive than initially hiring a lot of staff – and then letting them go again. The basis of workforce planning demonstrated here is very number-oriented.

But even if we are talking about people and personalities here, at the end of the day the numbers must of course add up. That means: Only if there is a business case for a job should it be done. Workforce planning enables this decision to be made on a sound planning basis.