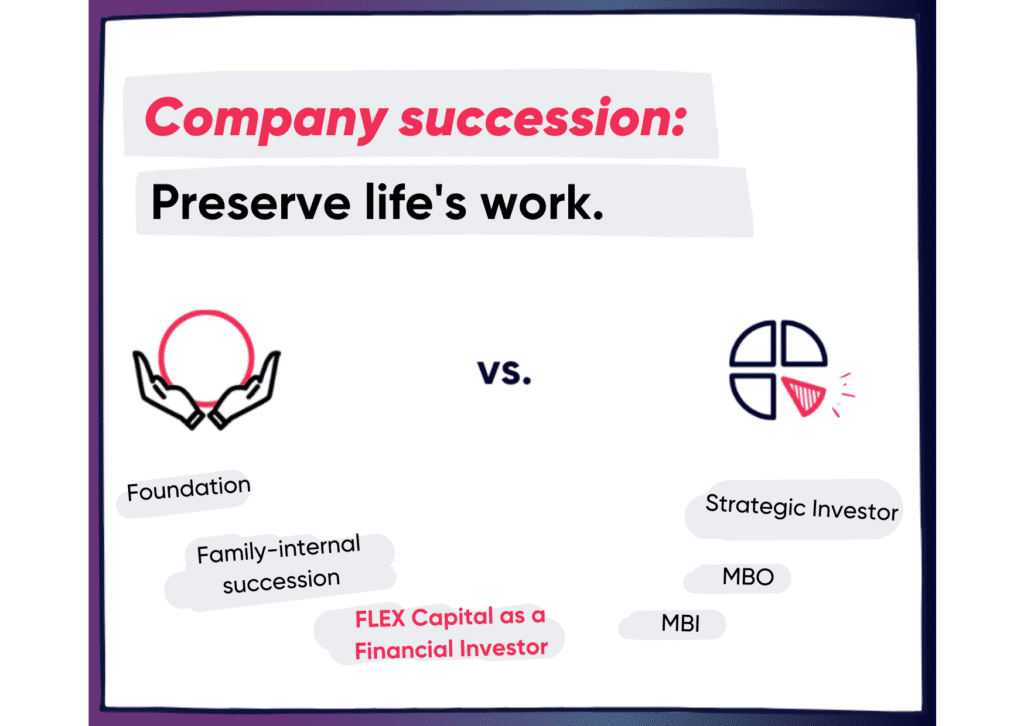

Finding the right succession solution is as individual as each company. Every entrepreneur has different priorities when it comes to selling their business and a unique vision of how the company’s future should unfold under the new owner’s stewardship.

We provide insight into the six most common business succession options and their advantages and disadvantages.

Family internal succession

- Family internal succession: This is the “traditional” form of succession.

- Family Internal Business Succession: Both the management and ownership of the company are transferred as a whole to direct/indirect family members (e.g., children).

- Family Internal CEO Succession: The management of the company is transferred to direct/indirect family members (e.g., children), but ownership is still controlled by the owner.

- External Management with Family Control: The management of the company is transferred to external successors (e.g., within/outside the company), but ownership remains with the family.

Equity participation scenarios in family internal succession:

Gifting the company

Selling the company

Company Inheritance

Company transfer

In return for the transfer of the company, the owner receives recurring payments. The owner may receive a monthly or yearly income, installment payments, or annuities as part of the business transfer.

Taxation and implications

In the case of an internal family succession solution, inheritance and gift taxes mainly come into play.

Advantages and disadvantages of the family-internal succession solution

Advantages

- Preservation of Company Legacy: The continuity of the company’s brand, culture, and traditions is ensured, preserving the founder’s legacy.

- Early Involvement and Training: Family members can be groomed and trained for leadership roles from an early stage, ensuring a smooth transition.

- Familiarity with Operations: Family members are already familiar with the company’s operational processes, leading to continuity and minimal disruption.

Disadvantages

- Significant Price Discount: The transfer price in family internal transfers might be lower than the market value, affecting the financial return for the exiting owner.

- Subjective Selection: The choice of family successors might be influenced by personal factors rather than merit, leading to potential issues if the chosen successor is not well-suited.

- Conflict Potential: Conflicts can arise due to differing interests between the exiting owner and the successor, especially when both parties have different visions for the company’s future.

- Acceptance of Successor: The new leader’s acceptance among internal (employees, management) and external stakeholders (suppliers, banks) is crucial for maintaining stability and trust.

Strategic investor

- Strategic investors are typically national or international corporate groups that operate in the same or related markets, such as competitors, customers, or suppliers.

- The motives for acquisitions are often diverse and are defined through the company’s strategic orientation. These motives include geographical expansions, product diversification, as well as scale and synergy effects.

Participation scenarios of a strategic investor

Horizontal extension

Vertical extension

Sale of the company to a strategic investor operating in the same market but at different positions in the value chain and supply chain.

Taxation and implications

- Basic tax distinction and relevance between an asset deal (sale of individual assets) vs. a share deal (sale of company shares).

- Treated and taxed as a regular sale of a business: Typically subject to income taxes (corporate income tax, trade tax, personal income tax), and potentially other transfer taxes.

Advantages

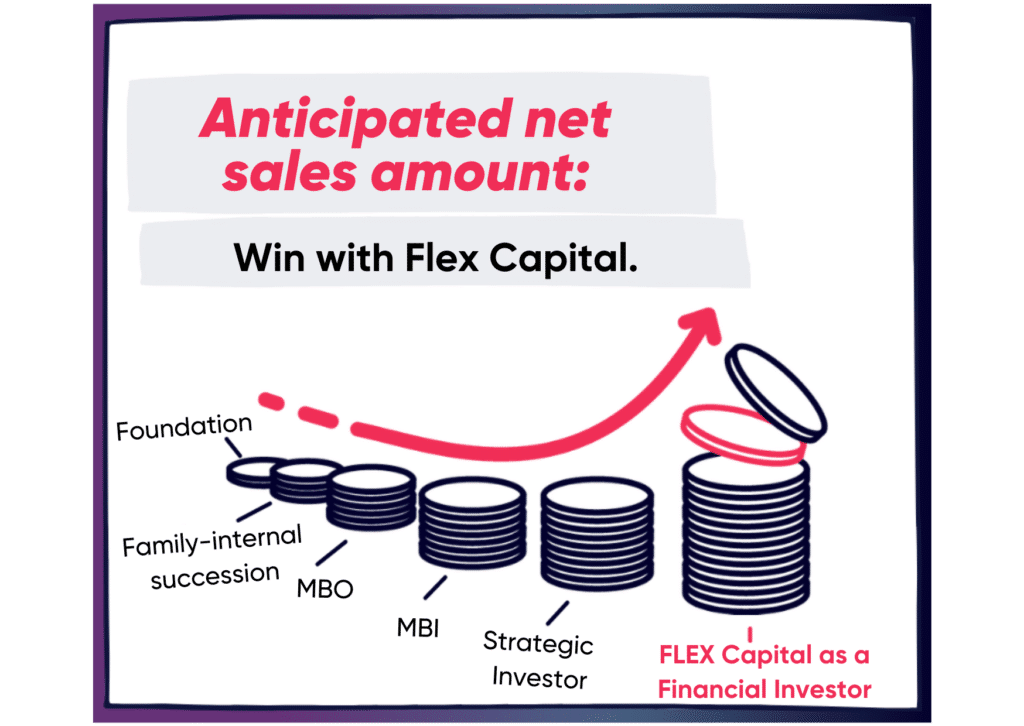

- Often, selling a company to a strategic investor results in a higher sale price (“strategic premium”).

- You gain access to established networks (e.g., through internal/external stakeholders such as management, customers, suppliers, etc.).

Disadvantages

- Loss of the company’s own brand and legacy due to integration into the acquirer’s corporate structure (“Post Merger Integration”).

- Significant limitation of entrepreneurial decision-making freedom and independence.

Financial investor

- Sale of the company to one or more private or institutional financial investors.

- Capital investment firms often specialize along the company and financing cycle as well as the risk/return profile, such as: – Early-stage companies/start-ups = Venture Capital investors – Established mid-sized companies = Private Equity investors.

- Differences mainly lie in the investment philosophy, meaning the investment size, expertise, network, and level of involvement in the strategic management of the company vary significantly.

Participation scenarios

Private Equity (FLEX Capital)

Sale of the company to a Private Equity fund. The primary goal is to unlock untapped potentials to drive the company’s further development. Autonomy remains largely intact. After a holding period of approximately 4 – 6 years, the company is divested. Private Equity funds are usually more professionally structured than Family Offices.

Taxation & Implications (identical to strategic investor)

- Fundamental tax differentiation/relevance between Asset Deal (= sale of individual assets) vs. Share Deal (= sale of business shares).

- Treated and taxed as a regular business sale: Typically, income taxes (corporate income tax and trade tax, personal income tax) are applicable, along with potential transfer taxes.

Advantages and disadvantages of a financial investor

Advantages

- Possibility to continue participating in the company’s development and value growth through a partial sale (while ensuring financial security).

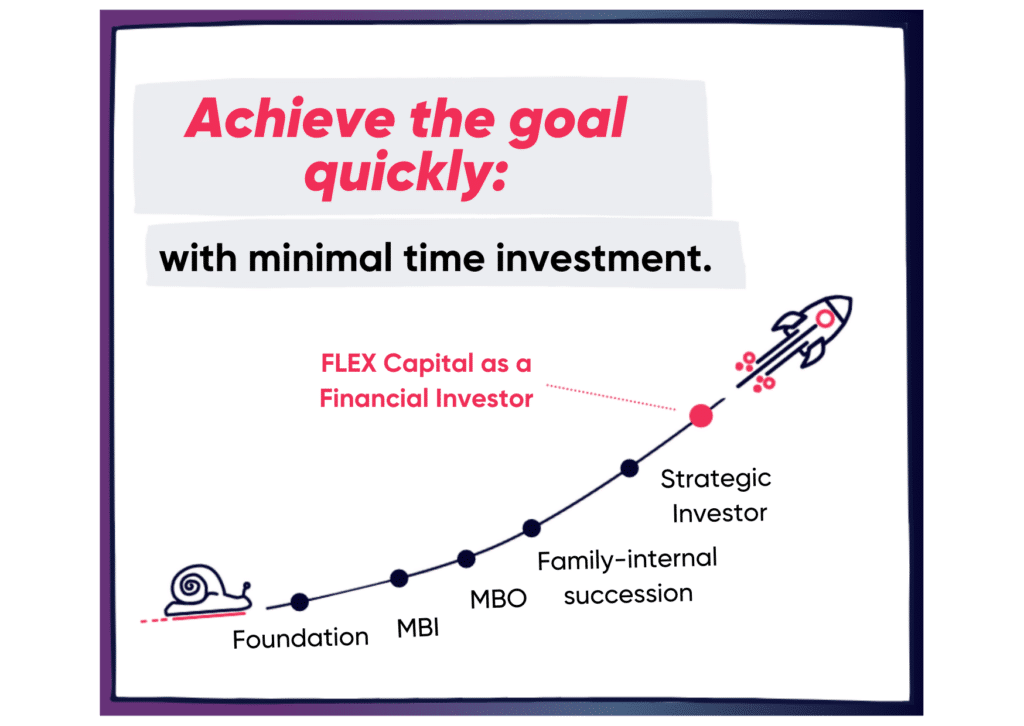

- Succession solution with the least time and effort; other succession options often require years of preparation, whereas a sale process to a financial investor typically takes only a few months.

- Access to prominent industry insiders with valuable know-how, experience, and important networks/contacts (e.g., other portfolio companies of the financial investor).

Disadvantages

- Depending on the investment philosophy of the financial investor, the level of influence may vary.

- Acceptance of the investor among stakeholders (Internal stakeholders = employees, management; External stakeholders = suppliers, banks).

Process Flow: Selling a Business to FLEX Capital

- The process begins with an informal introduction and initial discussion between FLEX Capital and the company’s management or founders.

- In preparation for more in-depth discussions, both parties sign a Non-Disclosure Agreement (NDA) to ensure the confidentiality of all provided company information. Following this, FLEX Capital gains insight into the company’s key performance indicators.

- An indicative review of the provided metrics and an initial analysis of the market environment are conducted by FLEX Capital.

- Based on the available information, FLEX Capital creates an indicative purchase price offer along with dedicated value creation strategies, such as online marketing initiatives, internationalization plans, and preliminary considerations for inorganic growth.

- If the indicative offer aligns with the seller’s expectations, a joint workshop is typically arranged with the management or company founders to test the identified value creation strategies collaboratively.

- Simultaneously, FLEX Capital deepens the company and market analysis through exchanges with product and market experts.

- Following this, FLEX Capital, alongside external consultants, commences a detailed due diligence process (Commercial, Financial, Tax, Legal, Tech), which generally takes four to six weeks.

- Concurrently, FLEX Capital prepares the necessary contractual documentation and aligns it with the sellers.

- Upon concluding contract negotiations, the purchase agreement is signed, and the agreed purchase price is transferred to the sellers.

Implementation of value creation strategies with FLEX Capital

Immediately after the contract signing, FLEX Capital, together with the management, develops a 100-day plan in which the jointly formulated value creation strategies are translated into specific actions.

FLEX Capital actively supports this process by providing its own expertise and facilitating connections with experts from the FLEX Capital network, without, however, interfering in the operational management of the company.

Upon implementation, a shared medium-term corporate strategy for the next three to five years is developed, which is based on the results and insights gained from the 100-day plan.

Throughout the entire investment period, close communication is maintained between the management and FLEX Capital.

Management Buy-Out (MBO)

- Internal succession to employed executives is referred to as a “Management Buy-Out” (MBO).

- In this scenario, managers who are already employed within the company assume ownership and control from the previous owner.

Participation scenarios

Equity financing

Financing through external investors

MBO successor candidates finance a majority stake in the company with the help of private or institutional financial investors (however, MBO candidates often require partial self-financing to ensure aligned interests).

The transfer of the company to MBO successor candidates, who repay the purchase price through deferred payments to the seller (purchase price deferral).

Financing through banks

MBO successor candidates finance the acquisition through bank loans. In return, the shares in the company serve as collateral (the ratio of equity to debt financing, as well as the amount and terms, also vary rarely, as a significant amount of equity from private funds needs to be raised for financing).

Taxation & Implications

- In the context of “Management Buy-Out” succession solutions, the process is usually similar to selling to an investor.

- However, special tax regulations come into play when the company is transferred to the new owners at a discounted value.

Advantages

- Transition of the company to executives who are familiar to the workforce and have already established themselves within the company.

- Simplified negotiations due to reduced information asymmetry (managers are usually familiar with the company for some time and can better assess existing risks).

- In case of financing through external investors:

– Access to the know-how and prominent network of the financial investor

– Active support in strategic and operational management of the company.

Disadvantages

- Frequent challenges in purchase price financing due to insufficient equity capital and potential resulting discount compared to a market price that could be achieved otherwise.

- Necessary transformation from executive to entrepreneur.

Management Buy-In (MBI)

- In contrast to the MBO solution, acquiring the majority ownership and control of the company by an external management team is referred to as a “Management Buy-In” (MBI).

- In this scenario, one or more external executives take over the majority ownership from the current owner.

Equity financing

Financing by external investors

Transfer of the company to MBO successor candidates who repay the purchase price through deferred payments to the seller (purchase price deferral).

Financing through banks

MBO successors finance the takeover by means of bank loans. MBO successor candidates finance the acquisition through bank loans. In return, the business shares serve as collateral (the financing ratio between equity and debt also varies rarely, as a significant equity portion must be provided from private financial resources for financing).

Taxation & Implications (identical to Management Buy-Out)

- In the context of “Management Buy-In” succession solutions, the process is typically similar to a sale to an investor.

- However, special tax regulations apply when the company is transferred to the new owners at a discounted price.

Advantages

- MBIs are primarily carried out by experienced industry insiders with valuable know-how and a wide network, who can bring new insights and momentum to the company.

When funded by external investors through equity financing:

Access to the expertise and extensive network of the financial investor.

Active support in the strategic and operational management of the company.

Disadvantages

- Frequent challenges in financing the purchase price due to insufficient equity capital and potential resulting discount compared to an achievable market price.

Foundation

- The succession solution within the framework of a foundation is suitable for avoiding inheritance disputes and potential scenarios such as the fragmentation or unintended sale of the company.

- This option is particularly chosen when (intergenerational) income security is the primary focus.

Taxation and implications

Foundations are generally not suitable as a “tax avoidance scheme,” but they do enjoy certain tax privileges compared to alternative succession solutions that can lead to tax savings through careful structuring.

Advantages

- The primary focus of the foundation strategy is to ensure the transgenerational security of the source of income, meaning that foundation earnings can be allocated to the founder and their family members to any extent.

- The foundation purpose is largely unchangeable, allowing the entrepreneur to create and secure a lasting institution as a legacy.

Disadvantages

- A foundation should be understood as a “rigid” succession solution, as the foundation purpose (with few exceptions) is irreversible and cannot be undone.

- Stiftungen unterliegen der Aufsicht und Kontrolle durch die Stiftungsaufsicht des jeweiligen Bundeslandes.