“I want to get rich.” – This is something only a few founders in Germany publicly admit when asked about their motivation. Those who mention money as a motivator risk their reputation. So, you often hear, “Money? It really doesn’t matter.” When entrepreneurs do dare to say that money is important to them, they often follow it up with an altruistic explanation: “I don’t want the money for myself, but mainly to give back to the startup scene through angel investments.”

It’s different in the USA: there, it’s socially acceptable to want to earn a lot of money. Entrepreneurs openly discuss their successes, and the public celebrates them for it. Most entrepreneurs in Germany avoid giving specific numbers, as can be heard in interviews like the OMR Podcast with Philipp Westermeyer, where he consistently asks for details but often receives evasive answers.

The ongoing discussion about partial exits also suggests that money is a central motivating factor for German entrepreneurs. The debate revolves around the question of at what point a founder or entrepreneur is no longer motivated to give their all to the company after a cash out. Opinions on this matter vary.

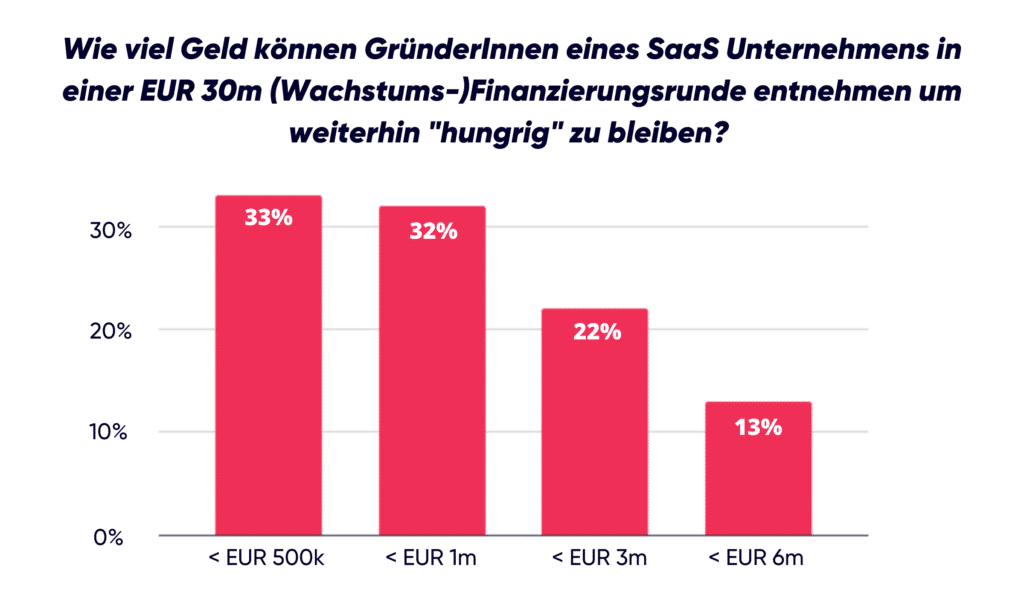

LinkedIn survey: At what cash out are founders no longer hungry?

When I founded my first company, Absolventa, in Berlin in 2008, it was unthinkable for founders and CEOs to take money off the table in financing rounds. In the following years, this stance softened somewhat: withdrawals in the lower six-figure range were okay, but beyond that, it was still not a realistic option.

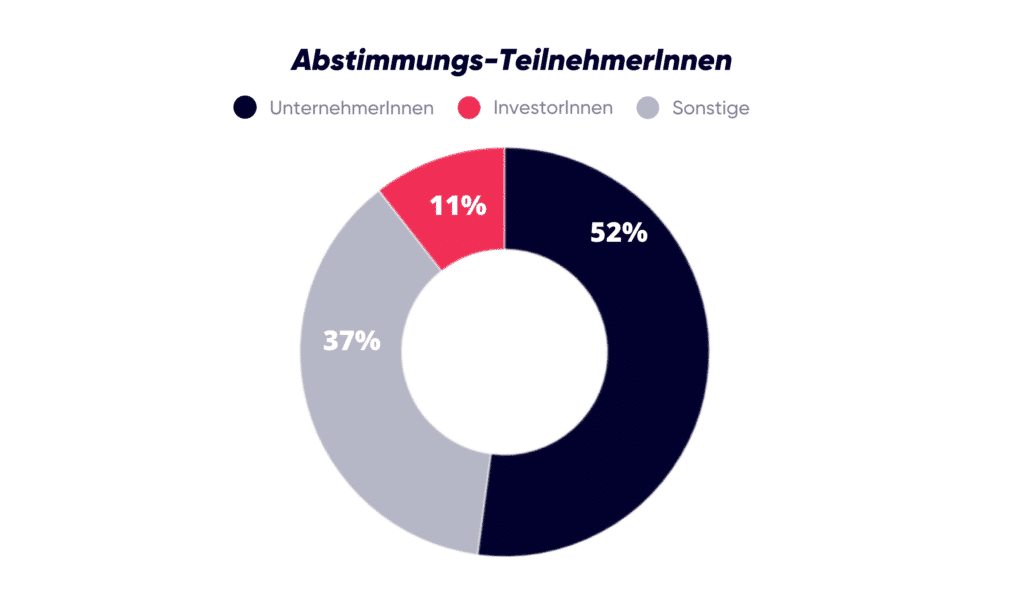

I recently conducted a survey on LinkedIn where I outlined a hypothetical case of a €30 million growth financing round and asked the question: At what amount founders take for themselves, do they cease to be considered “hungry”? 192 people from my network responded, mainly entrepreneurs and investors.

From conversations with experienced M&A advisors for financing rounds of this kind, I know that in practice, cash-outs between 1 and 2 million euros are common.

Partial exits and cash outs at FLEX Capital

At FLEX Capital, we focus on majority investments in the German-speaking internet and software market. We invest in growing companies with revenues starting at 5 million euros and EBITDA of at least 1 million euros, using equity tickets of up to 25 million euros from the fund. Additionally, co-investors, banks, or debt funds often join us, further increasing the exit price for the founders.

Since we prefer working with entrepreneurs who have built their company in bootstrapping mode, meaning they have relied on little or no external capital, the founders often hold a significant portion of the company’s shares at the time of majority sale. As a result, the cash out for the founders tends to be substantial.

Binding entrepreneurs to the company to grow it together is a key aspect of our investment strategy. Accordingly, we have thought extensively about the relationship between motivation and money and openly discuss this with the entrepreneurs of our portfolio companies.

Greed for money? What really motivates founders

Of course, it’s not possible to generalize all entrepreneurs. However, I believe that over the years, I have recognized some recurring motivations.

Entrepreneurs are usually driven by a strong vision. They also want to make a positive contribution to society with a fulfilling mission and, of course, achieve financial success.

Money is a central motivator, but entrepreneurs typically don’t aim for it because they want to indulge in a lavish lifestyle. The proverbial Ferrari after the exit is actually bought by very few, even if they dreamed of it in their youth. If anything, the privately used property might be a bit larger, and they might stay in 5-star hotels instead of 4-star ones. Exceptions certainly exist, but for the vast majority, their personal lifestyle doesn’t change significantly.

Why money still plays a central role? Because in entrepreneurial circles, it’s the accepted currency for success. Success that one wants to prove to their own family, friends, and ultimately, themselves. In the end, money is also a tool to make one’s own success comparable. “Why did the other entrepreneur earn so much more for their performance than I did? I delivered just as well, if not better, right?” Recognition is often the real driver behind the desire for high profits and cash-outs, rather than greed for more consumption.

How investors and founders come together

If investors want to continue to rely on the central involvement of the founder-CEOs after their entry, they must be aware that they need to provide them with a financial incentive.

The amount that ensures this depends on our experience at FLEX Capital, which is derived from the relationship between the cash realized by the founders at the time of the investor’s entry and the cash that can still be achieved in the future.

For example, if a founder takes 1 million euros off the table when the investor enters, and realistically, another 500,000 euros are possible over the next two years, then 1 million euros in cash-out is too much. Because the founder won’t be motivated to pursue another 500,000 euros after the initial 1 million.

On the other hand, if a founder transfers 10 million euros into their personal wealth and another 40 million euros are realistically achievable over the next three to four years, the situation is different. Despite the relatively high initial cash-out, the founder will likely remain deeply involved in the company’s management to secure the additional 40 million euros.

Conclusion: A realistic assessment is required

The question of at what cash-out level founders lose their motivation doesn’t have a universally applicable answer. However, it’s clear that the relative amount matters more than the absolute figure.

Absolutely, assessing a founder’s motivation after a partial exit should consider not only the financial incentive but also their individual circumstances. Questions like how important the company’s mission is to them, whether they align with the future business case, their resilience and stamina for potentially challenging years ahead, and their family situation all play a role. The cash-out amount alone doesn’t provide meaningful insights into their future commitment.