Mid-2014, I was sure: Now is the right time to sell my first company, Absolventa. In the recent past, I had several conversations where the phrase “You’ve built a cool company. If you ever want to sell, let us know” was frequently mentioned. There was no concrete offer yet, but I had the feeling that a good exit was possible.

In the shareholder circle, we unanimously decided to initiate a sales process.

“Thanks to M&A advisors, two buyers bid up.”

Since I had no prior experience in selling a company at that time, I decided to engage an M&A advisory firm. My directive was to show me potential buyers I hadn’t come across before and assist me in creating a structured process to generate a bidding competition that would result in the highest possible sale price. This clear directive worked well for me: in the end, two buyers emerged as top contenders, whom I wouldn’t have identified on my own in the same way.

I have gained more experience since then and have also assisted entrepreneur friends in selling their companies as advisors. This allowed me to step into the role of an M&A advisor myself at one point.

What distinguishes good M&A advisors, I now experience at FLEX Capital from a third perspective: either they show us interesting companies that are for sale or we engage them to sell our portfolio companies.

The basic competence of M&A consultants

M&A advisors can provide valuable support in various aspects of the sales process. Not every advisor has the same expertise in every area. Therefore, founders should consider what profile an advisor should have.

What M&A consultants support

The range of services provided by advisors ranges from simple support activities to the facilitation of complex negotiations. Here is a brief overview:

- Development of the Equity Story

- Preparation of the sales documents

- Preparation of the data room

- Identification and approach of potential buyers

- Setting up the sales process

- Review and evaluation of incoming offers

- Support during bid negotiation

- Consultant and sparring partner during the sales process

Management teams that have bootstrapped their company, never created a real business plan, and have no experience in dealing with investors need different M&A advisors than founding teams that have already completed three financing rounds. In the first case, the advisors need to provide hands-on support with the basics. In the second case, well-prepared business documents are usually available, and the managers are skilled at presenting their company.

In my experience, every M&A advisor is capable of compiling sales documents, creating a business plan, and preparing a data room. Everyone masters the basic tools, but there are competencies in which the advisors differ.

What first-class experts bring to the table

Entrepreneurs who expect more from their advisor than the basic program should, in my experience, keep an eye on the following topics:

- Relevant deal track record: Has the advisor already accompanied sales in the respective industry? Do they know the buyers and what they value? Are they familiar with industry trends?

- International footprint: If entrepreneurs want to involve foreign bidders, the advisor should have international experience and, most importantly, contacts. A first step is for M&A advisors to have a cooperation with a US-based M&A boutique. Even better is if the advisor is part of a global team that operates on a shared profit and loss statement, so international partners have a vested interest in successfully completing the German deal. However, an international footprint is not central for every deal: a smaller German company with a national business may be better served by an advisor specializing in the German market.

- Powerful organization: Small M&A boutiques are not inherently bad. However, they need to have sufficient resources to manage various bidders under time constraints. If multiple due diligence processes run in parallel and the boutique is too small, delays may occur, which could lead to investors pulling out in the worst-case scenario.

- Good work ethic: M&A is a high-pressure business where a nine-to-five mentality rarely leads to success. Consultants must be willing to go the extra mile for their clients.

- Trustworthy salesperson: Before engaging, entrepreneurs should inquire about who the responsible consultant will be and get to know them. Sometimes, consultants act like insurance brokers and can scare away potential buyers. A good consultant knows the M&A agenda of the interested party and can communicate with them on an equal footing.

Two factors by far the most important

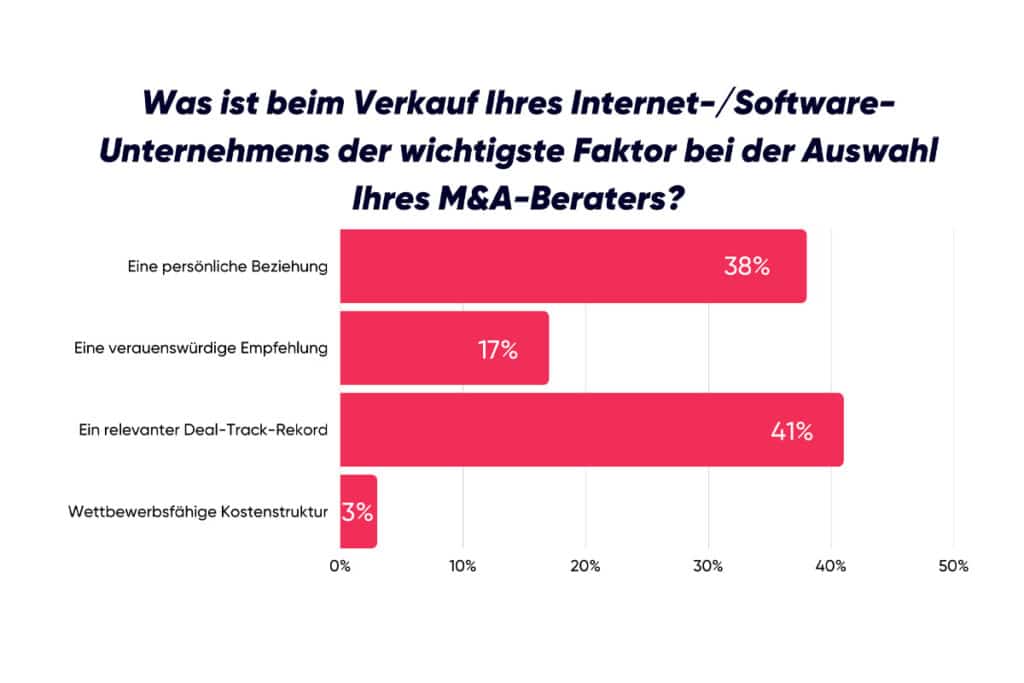

Which criteria are most important for entrepreneurs in practice? I conducted a survey in my LinkedIn network with 29 participants from various groups. Although the responses are not representative, they are interesting in their clarity: 41 percent cited a relevant track record as the most important criterion for choosing a consultant, followed by a pre-existing personal relationship (38 percent). Recommendations play a less significant role at 17 percent. The fee structure is far behind in last place.

The results align with my assessment. Those who have known their consultant for a long time can assess their work ethic well, whether the conversations are conducted on equal footing, and how the firm is structured. If the consultant has already closed relevant deals, knows the respective market and its buyers, they will be able to structure your sales process successfully.

A word on costs: Yes, good consultants are not cheap, but in my experience, they are worth their money. It’s not worthwhile to push fees to the absolute limit. In case of doubt, this could result in your deal receiving lower priority compared to other ongoing mandates.

Instead, consider fee models that provide consultants with incentives for overperformance. This way, everyone involved is motivated to achieve a lucrative sale quickly. You should be skeptical if a consultant’s pricing structure is significantly below the market average or if consultants are willing to negotiate their prices significantly. As the old saying goes, “Pay peanuts, get monkeys.”

Early talks, lucrative exits

For entrepreneurs, there are many reasons to consider the assistance of an M&A consultant. To ensure that the investment pays off, founders should take their time in making the selection. Ideally, you should build relationships with potentially suitable consultants early on.

Esteemed consultants often approach relevant companies themselves, even early on. You should take advantage of these opportunities, even if your company is still too small for an exit. This way, you can learn about what’s happening in your industry in terms of M&A, current valuation levels, and what buyers are looking for. All of this information will help you, as a CEO, plan the further strategic direction of your company, with the aim of achieving a truly successful exit in two or three years.