The central importance of sustainability for our society and economy has not been overlooked by the private sector. On the contrary, the private sector plays a key role in advancing the climate and sustainability goals developed by the UN. Many companies have already taken a leading role in sustainability and are integrating sustainability goals into their strategic business decisions. The world of investors goes even further by developing a systematic approach to promoting sustainability. The so-called ESG factors (Environmental, Social & Governance) serve as a foundation for investors to analyze and evaluate companies in terms of their sustainability. This demonstrates that sustainability is not only an ethical obligation but can also create business value. It is encouraging to see how both companies and investors are increasing their efforts in this area to create a more sustainable future.

For us at FLEX Capital, sustainability is a high priority, and we consider it at every stage of the investment process. I would like to share our perspective on the general relevance of ESG (Environmental, Social, and Governance) from an investor’s standpoint and what it means for entrepreneurs when ESG criteria are taken into account in the investment process in this article.

What is ESG?

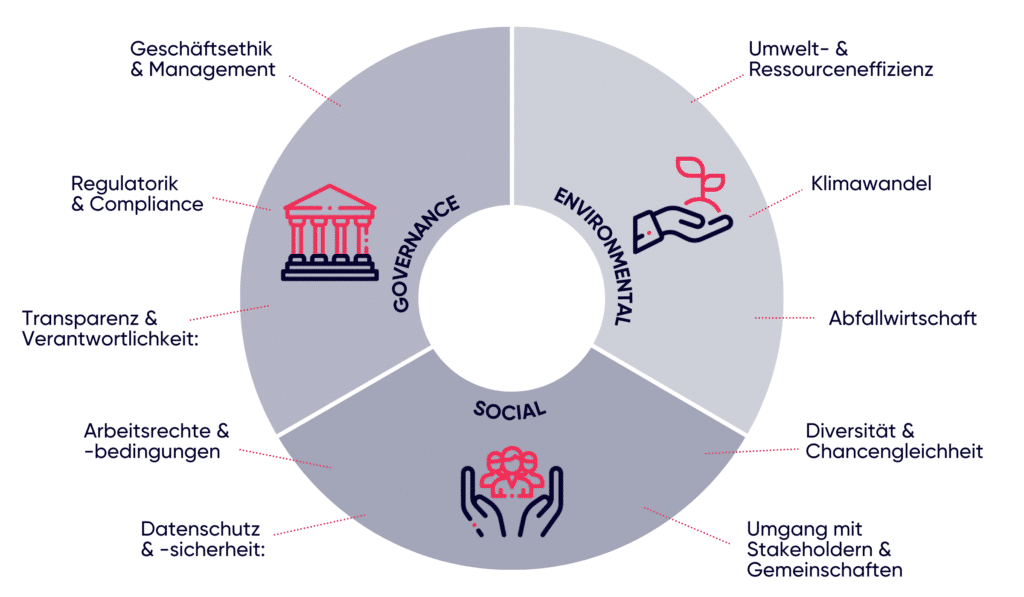

ESG is often associated with “sustainable investing.” The ESG factors are the three overarching criteria used to assess the sustainability of an investment. Investors are increasingly taking these criteria into account in their investment decisions. What these criteria specifically mean and how they are applied can vary from one investor to another. In general, however, the criteria encompass the following factors:

E like Environmental

This criterion encompasses all the impacts that a company has on the environment. This includes a company’s carbon footprint, its management of water and waste, as well as the environmental impacts of the products it offers. Additionally, this criterion examines any activities or efforts by the company to reduce its carbon footprint, water consumption, or waste.

S like Social

The social criteria include the company’s treatment of employees, customers, suppliers, and other individuals within the company’s social sphere. This also encompasses the company’s efforts and activities related to workplace safety, employee health, human rights, and general working conditions.

G like Governance

This criterion examines the quality and effectiveness of corporate governance and ethical behavior of the company. It includes factors such as clear definition of rights, responsibilities, and expectations among various stakeholders in company leadership. Additionally, this criterion covers aspects like equal opportunities, diversity, transparency, and the company’s stance on corruption.

Our principles:

Our approach to responsible investing and the key ESG issues are highlighted in our FLEX Responsibility Framework. It covers essential ESG topics and is based on comprehensive benchmarking of best practices and industry standards. We are constantly working to adapt our framework to regulatory changes and emerging ESG issues and to meet the expectations of our investors. All our portfolio companies, as well as FLEX itself, are assessed based on this framework at every stage of the investment cycle.

Environmental:

- Environmental and Resource Efficiency: Responsible and efficient use of resources, including water and energy, as well as the utilization of sustainable energy sources.

- Climate Change: Strong environmental awareness and commitment to promoting carbon neutrality, especially in terms of travel and fleet management.

- Waste Management: Reducing the amount of waste generated and environmental pollution caused by waste disposal through recycling and reuse.

Social:

- Diversity & Equal Opportunities: Actively promoting diversity and ensuring equal opportunities regardless of gender, ethnicity, disability, or religion.

- Stakeholder & Community Engagement: Respect for the local societal contexts in which we and our portfolio companies operate, as well as respectful engagement with all our stakeholders.

- Data Privacy & Security: Adequate data protection measures in handling all private data and compliance with local regulations.

- Labor Rights & Conditions: Adherence to labor rights and ensuring working conditions that go beyond basic health and safety standards.

Governance:

- Business Ethics & Management: Adherence to standards related to good corporate governance and ethical behavior, especially concerning corruption, harassment, and other misconduct.

- Regulation & Compliance: Adherence to all laws and regulations according to local applicable requirements.

- Transparency & Accountability: Transparency regarding our ESG commitments and the progress of their implementation, including regular reporting on all ESG-related issues.

Why is ESG relevant for investors and entrepreneurs?

The high relevance of ESG for investors and entrepreneurs is influenced by several factors. One important aspect is the growing public awareness of sustainability and environmental protection. Supported by movements like “Fridays for Future” and “Black Lives Matter,” this awareness is increasingly pressuring investors and companies to consider ESG factors more in their decisions.

Furthermore, there is an increasing number of studies demonstrating a positive effect of ESG activities on company performance. The reasons for improved performance are easy to understand. Companies that operate sustainably and convey a positive ESG image can gain a competitive advantage and accelerate their growth. Moreover, efficient resource management, such as energy and water conservation, can reduce costs for the company.

Even though many companies are currently facing extreme circumstances due to the COVID-19 situation and understandably prioritizing the present in their decisions about the future, the importance of ESG has by no means diminished. On the contrary, several studies show that considering ESG criteria can enhance a company’s resilience during times of crisis(EY, 2020). Entrepreneurs who consider ESG factors in their company strategy often have a better understanding of how their business actions impact the environment and stakeholders. Additionally, they usually have a better grasp of ESG-related economic risks, which, according to the World Economic Forum’s 2020 annual risk report, are among the top 5 most likely and severe risks to the global economy. This knowledge advantage serves as critical input for developing a sustainable and resilient long-term business strategy.

What do investor ESG guidelines mean for entrepreneurs?

The precise interpretation of ESG criteria and their implementation varies for each investor. Our approach at FLEX Capital includes clear ESG guidelines that are integrated throughout the investment process. This has the following implications for our potential and active portfolio companies:

Check against exclusion list

We evaluate each potential investment against our exclusion list. This list includes industries, business models, and activities in which we will not invest based on our moral and ethical values.

ESG due diligence

As part of an ESG due diligence, we assess potential investments using our “Responsibility Framework.” This framework covers what we consider to be the most important ESG topics and is based on extensive benchmarking of best practices and industry standards. Entrepreneurs should expect a thorough examination of their ESG activities. In addition, all potential portfolio companies must meet the minimum ESG standards defined by us. Identified ESG risks or a poor ESG rating can result in a reduction in the purchase price or a negative investment decision.

ESG Targets & Reporting

During the investment period, we support our portfolio companies in ESG management to ensure the implementation of our ESG guidelines. To do this, we work together with the portfolio company to define ESG goals and an implementation plan. The progress of implementation is then regularly evaluated.

Even though considering ESG criteria in the investment process may initially require more effort from the entrepreneurs of active and potential portfolio companies, they ultimately benefit from the positive performance effects. Finding a way to avoid the ESG issue seems difficult anyway. According to a PwC study from 2019, more than 90% of the surveyed private equity funds already have formal ESG guidelines or are in the process of developing them. It is expected that this percentage will continue to increase, and many funds will further professionalize and develop their ESG guidelines in the coming years.