Customer acquisition is a focus for many entrepreneurs. It’s no secret that this comes with high costs, especially for SaaS companies. The customer growth achieved through these investments is proudly presented in company presentations and investment memoranda, which I, as an investment analyst at FLEX Capital, review. Of course, the number of newly acquired customers is an important metric for my analysis and evaluation of potential investments—after all, growth is one of our central investment criteria at FLEX Capital.

However, in the due diligence process, I’m even more interested in the answer to a different question: What happens to the customers for whose acquisition the company has worked so hard and invested so much, after a few months or years? Typically, a critical number of them churn or downgrade. I’ve summarized here why the churn rate, which is the rate at which customers churn, and the reasons for customer churn are important factors in our investment decision.

1 – The strong effect of churn on growth rates

Many entrepreneurs see acquiring new customers as a central driver of revenue growth. However, customer retention is an equally important factor. The ‘leaky bucket’ is a popular analogy to illustrate the effect of churn on customer numbers and, consequently, revenue. Every month, software companies pour new customer revenue into the revenue bucket at the top. However, the bucket has a leak through which revenue flows out when customers churn. The fuller the bucket becomes, the more pressure is exerted on the leak, and revenue flows out even faster. Eventually, an equilibrium is reached where as much revenue flows into the bucket as flows out. When this equilibrium is reached depends on two factors – the size of the leak (churn rate) and the speed at which new revenue flows into the bucket.

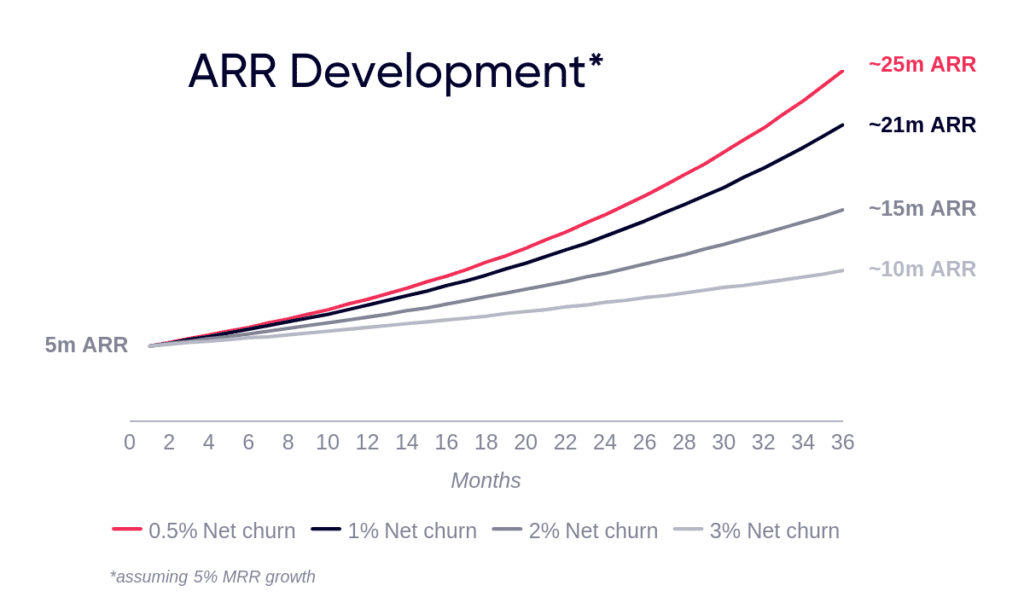

As a result, two companies with identical acquisition rates of new customers (the speed at which revenue flows into the bucket) can have significant differences in revenue (the bucket’s fill level) after just a few years due to different churn rates (the size of the leak). In the example graphic, each of the companies is growing at 5% monthly through newly acquired customers (MRR growth). However, due to the different churn rates, there are differences in ARR of almost 15 million euros after 3 years. Therefore, the churn rate has a crucial impact on the scalability of a software company, which is an important criterion for our investment decision.

2 – Churn rates have an important influence on cash flow

High churn rates also increase the payback period for Customer Acquisition Costs (CAC). This, in turn, has a negative impact on cash flow development in a company. Increasing churn rates, as well as significant fluctuations within cohorts, can lead to cash flow instability. As a Private Equity investor, the stability and level of cash flow are crucial factors for our investment decision. Especially in the case of software companies, which already have a high CAC payback period due to their business model and market focus, low and/or decreasing churn rates are even more important for a positive investment decision.

3 – Churn as a “Hidden Box of Information

However, churn rates can reveal much more about a company than just scalability assessment and the strength or stability of cash flow. High churn rates can also be an indication of a poor Product-Market Fit, usability issues, intense competition, or general customer stickiness in the market. To better understand these dimensions, it is often necessary to not only look at the monthly or annual revenue churn rates but also examine the developments of churn rates across individual cohorts and the reasons for churn.

For example, in the case of B2C SaaS companies, which generally have higher churn rates than B2B SaaS companies, it is crucial to understand how many of the churned customers have “involuntarily” churned. Involuntary churn means that customers did not actively cancel but were classified as churned due to issues like missed or failed payments. This involuntary churn can often be reduced quickly through targeted measures and is therefore less relevant to our investment decision. Churn caused by customers who habitually cancel immediately after subscribing to their software subscription also plays a minor role in my assessment as an investment analyst.

However, even after considering “involuntary” churn, if churn rates in the first few months are relatively high, it may indicate usability problems or issues with product-market fit. If churn rates remain stable over an extended period and then suddenly increase, it could be a sign of increased competition or the entry of a competitor with a better product and/or value proposition. Churn rates reveal to us which areas we should analyze in great detail during the due diligence process.

Conclusion

Churn is a key metric for us as investors, as it has a significant impact on cash flow stability and scalability of a company. Due to the strong sensitivity of revenue growth to the churn rate, it also has a crucial influence on our company valuation. Additionally, the churn rate provides us with insights into further strengths and weaknesses of the company that require detailed analysis during the due diligence process. For example, if it turns out that one reason for customer churn is usability issues with the product, we can expect higher costs for product development in the coming years. These costs must be considered in the business plan and can potentially affect the company’s valuation as well.